Let it rain

Or is it make it rain? Regardless, it is raining positive sentiment today in markets.

Atmospheric rivers can bring topographical change. Evidently they can alter market forces as well.

What an attitude change overnight across all markets. Grumblings across the industry started last week in almost all my meetings that we are simply oversold. It does feels bottom’ish.

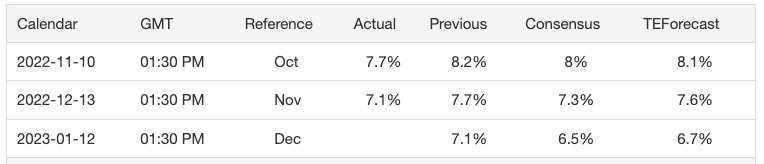

December CPI numbers come out Thursday, January 12 with consensus at 6.5%. Below are the last 2 months and forward looking numbers for this Thursday. It does pain my heart we are at the will of inflation and the fed to point the direction of market prices for stateless money and the open financial system, put simply though, this is where we are historically. It’s still early for Bitcoin and cryptocurrencies.

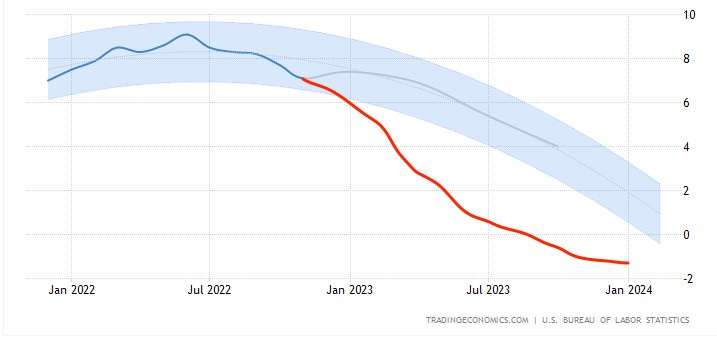

I love the forecast chart below by Trading Economics. I’ve taken some liberty and added in what I think is possible. For now, velocity seems to be decreasing at a faster rate than modeled. Specifically around lending and the housing market. There are millions of millennials who were chomping at the bit to purchase a home when inventories were low and rates were favorable.

Below the inflation forecast graph you can see the 30-year mortgage rate. The increase of rates was so violent most of these families simply did not have time to adjust. They looked at rates, the lowest in history, and went shopping and in less than a year were completely priced out of the market. At a loan-to-value (LTV) of 80/20, meaning you put $100,000 down on your $500,000 home in January 2021 that home cost you $1,632/mo in principle and interest. Today, your P&I is $2,602. An extra $1,000 a month after taxes is another $20,000 earned in salary. Here about a lot of salaries bumps in the last 6 months?

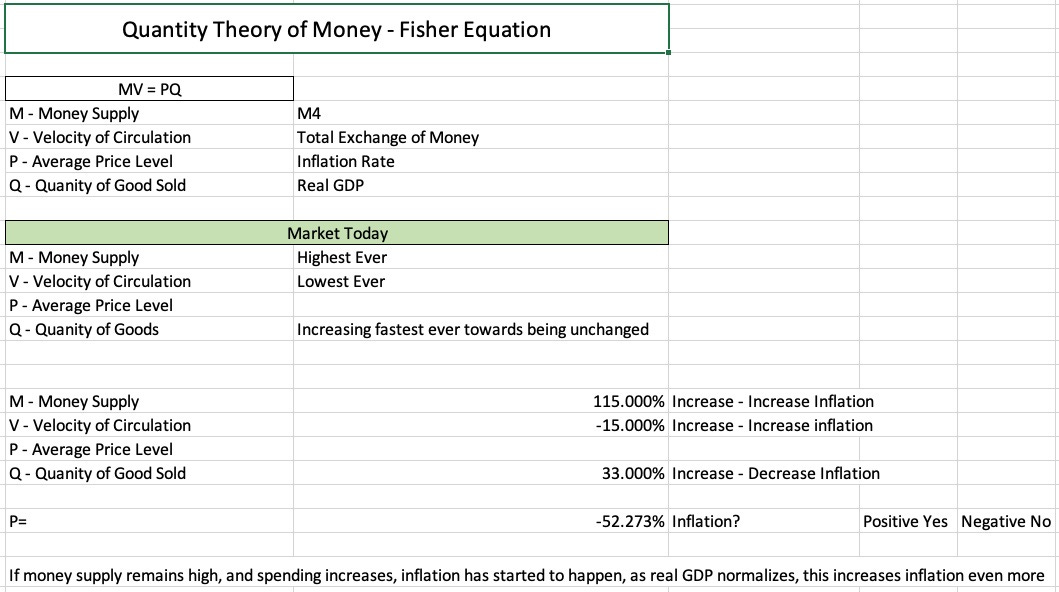

I created this spreadsheet on Jan 18, 2021. The Fisher Equation is pretty simple. If money supply increases, while people spending more money, and more goods are being produced/sold, you increase prices and therefore inflation.

At the time, money supply was the highest ever, velocity coming out of COVID and having a major second wave was the lowest ever, quantity of goods was increasing (supply). It was a perfect setup to spur the economy. Unfortunately we drastically overheated as a small increase in velocity would now have a major effect on prices. Hence the volatility you’ve seen in fuel and your visits to the supermarket.

Today the major adjustment to that equation is the V, velocity of money. Demand for large ticket spending is falling faster than what is modeled as lending as all but dried up. Inflation is easing and I believe it’s easing quicker than forecasted.

—