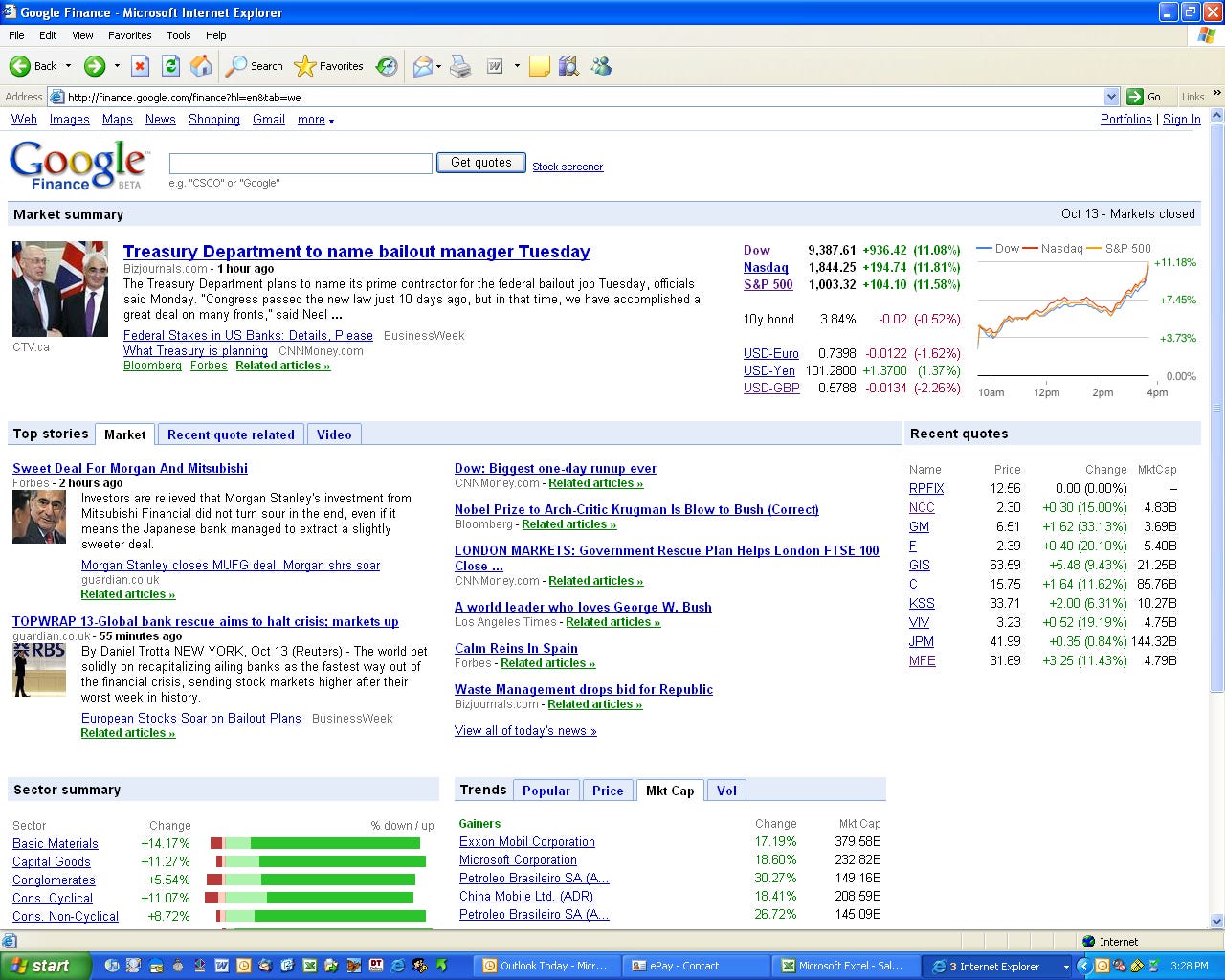

Largest One Day Run-up ever.bmp

I took this screenshot on August 9th, 2009. I was sitting in my cubicle on the 21st floor near 600 N Michigan Ave in Chicago. It was one of the first times I was experiencing history, rather than just reading about it, and I wanted to document it. I quickly sent the screenshot to my Gmail account, where I knew it would be preserved for a long time.

I cannot help but be reminded of this history as governments around the world are scrambling yet again to instill confidence across markets to stave off what they know is possible once more.

The question everyone is asking today is: how deep does the contagion go? How have executives across the banks managed their risks to consistently fulfill the public markets' never-ending need to beat earnings? How risky did they get this time? Are they forced to take more risk because everyone else is doing it? Are there options where they don't have to take these risks?

The list of questions goes on and on.

There are differences this time. We did not have mass adoption of Bitcoin or DeFi in 2009. Believe it or not, only 71% of Americans were on the internet in 2009 compared to 92% today. Currently, over 40 million people own cryptocurrency in the US alone. Though cryptocurrencies are not a complete opt-out yet, I do see this contagion pushing more people towards Bitcoin and the rest of the cryptocurrency market.

I anticipate the development of tools specifically targeted at simplifying banking. Self-custodial credit cards, self-custodial banking accounts. It’s all coming.